Tired Of Hearing How Others Are Making Money

From The Stock Market But Not You?

Get The Straight Scoop On How To Start Making A Profit From The Stock Market in 5 Days or Less

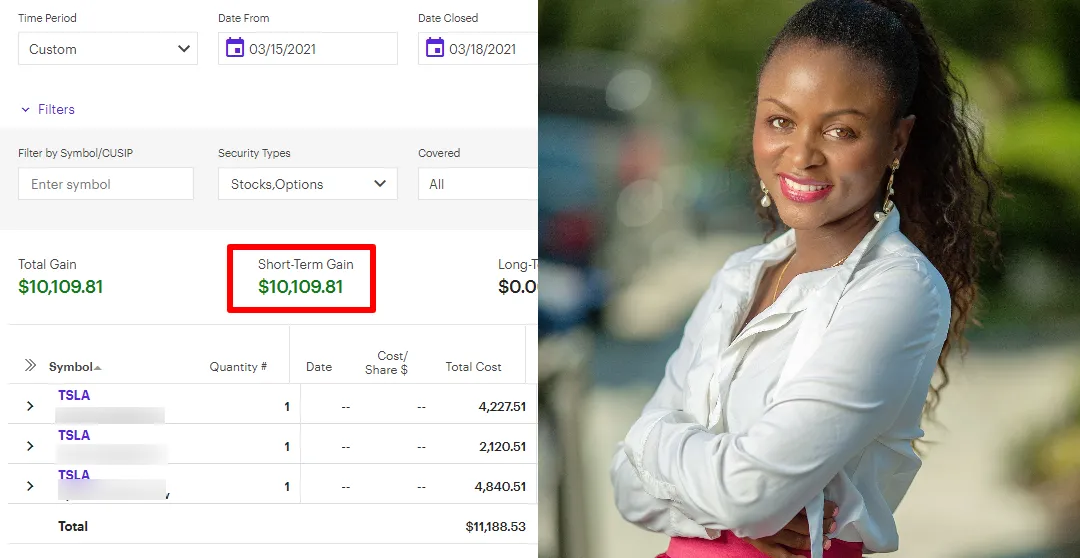

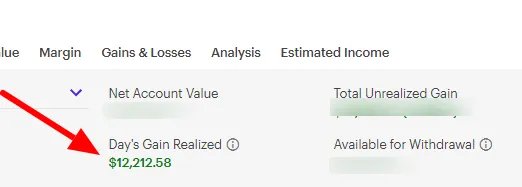

Learn the same strategies I use to make

4 and 5 figure trades each month

AVAILABLE FOR A LIMITED TIME ONLY!!!

Hello!

I'm Belle Niba

I am not a guru. I do not have Wallstreet friends giving me inside tips. Far from it. I started my investment journey very much like you are now. Uncertain and overwhelmed with all the information that was available. Good information yes, but when you are not savvy about these things it can feel like trying to drink water from a firehose.

Things like candlesticks, deltas, gammas, earnings statements etc … gave me a headache. I needed things to be much simpler as a newbie so I figured out a way to keep it simple … and each year my portfolio has thanked me for it.

Here's What We Cover...

DAY 1 - Overview And Setup: We hit the ground running with the set up you need to get started. I share the same tools I use so you can get set up and ready to go.

DAY 2 - Passive Investing: We go over a very simple long term set up that is beginner friendly and can be set up quickly. It requires very low maintenance and will get you well situated long term.

DAY 3 - Active Investing: We start looking into generating money in the short term. This is where you start looking at generating income for the now.

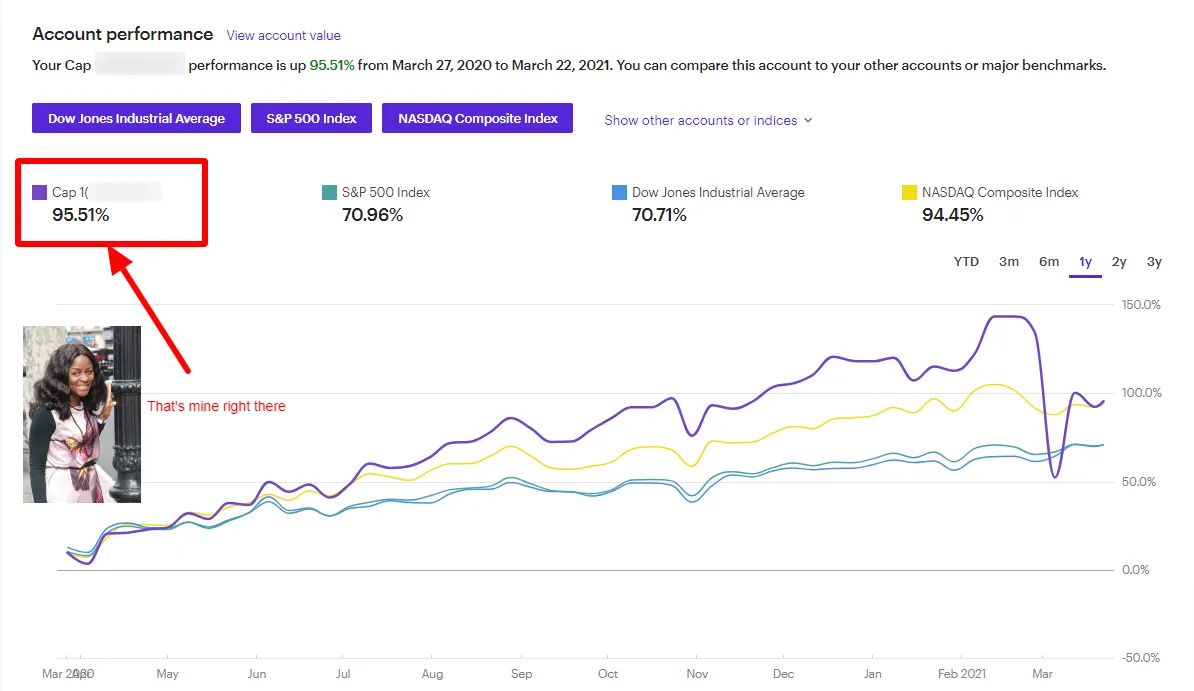

DAY 4 - Using Leverage To Cash Out: We will go over 2 strategies I use often to get money out of the market. You will see how I leverage stocks I already own that are losing to make money as well as how I sometimes make over 95% return on my investment in just a week like when I invested a little over 11K to make 10k in profit within a week.

DAY 5 - Profiting From A Down Market: Stock price dropping? I'll share 2 strategies I use to profit from that as well. Just a few days ago I cashed out over $3k just on these strategies alone.

- BONUS: 8 Strategies I Use To Find Opportunities In The Stock Market

- BONUS: How To Reduce Your Risk With Market Neutral Strategies

- BONUS: Key Financial Ratios To Look At And What They Reveal

By The End Of This 5 Day Action Packed Bootcamp, You Will Have The Same Strategies I Use To Generate Over $10K On Average From The Stock Market Each Month

**TOTAL VALUE: $997 (Actually, it's a lot more)**

JOIN TODAY FOR ONLY: $97

How I Got Here...

Today I use simple strategies to make deals in the stock market that generate 4, sometimes 5 figures in gains a week but it wasn't always this way.

Armed with information and motivation, I was ready to put my money to work through investments.

There was just one problem. I wasn’t sure where to begin. I had narrowed my investment options to Real Estate or Stocks. I decided the stock market had a lower barrier to entry and would require less effort and capital on my part to get started. So I embarked on learning as much as I could. Unfortunately, even after reading lots of different material, I still wasn’t sure how to go about it as a beginner.

I had to piece things together bit by bit. Don’t get me wrong. The information was out there, I needed it distilled a little bit more. I didn’t know what I didn’t know and the pieces just seemed too many for the novice that I was.

The big question I had was “How do I know what stock to buy?“. I wanted a simple approach to identifying stocks but wasn’t sure where to look. I googled and searched long and hard. Sometimes the answers were right in front of me but I didn’t even know it. It didn't help that the stock market gurus didn’t always agree on what stocks were a good buy. One day they could be saying ‘buy, buy, buy’ and the next it was ‘sell, sell, sell’ … I found that to be quite unhelpful.

As I continued my quest, feeling discouraged and overwhelmed by all the information available, I had a ‘breakthrough’. One fine day, a dear friend of mine on Facebook passionately encouraged me and pretty much all his friends to jump on an IPO. He warned us not to miss out on that boat. At first, I ignored his warning but something inside of me cautioned me not to become one of those people who hesitate when opportunity knocks and then miss out.

So I decided to check out the company he was recommending. I tried to do my due diligence – I pulled up information on the company, went to their website and read about who they were, went to google and pulled up as many articles as I could find on them. There was a lot of media hype around this company. After some time, I came to the realization that my level of uncertainty had not improved😕. It wasn’t that there wasn’t information, the issue I had was that I just wasn’t sure what the information was telling me.

I finally decided to take the plunge – if so many people were saying it was a good buy, why would a novice like me disagree?

I decided to jump into the ring. I was tired of standing by the sidelines. I made the bet and bought the stock. Shortly after, buyer’s remorse kicked in. I questioned whether it was a smart buy or not. I didn’t know. I promised myself to sell the stock the first chance it grew in value. But then …. the stock price started dropping. First it was a small drop, then a big drop, then an even bigger drop 😲. My fears had just materialized. The stock went on a free fall of sorts. Halfway down, I bought some more. Digging in and hoping to improve my situation. Things did not get much better. Actually, they got worse 😩. (Today that stock is at 8% of the value I bought it at. Yes, you read correctly, that is a 92% loss. Imagine that).

I was devastated 😭! I had fallen for one of the ‘deadly sins’ of investing. I had succumbed to hype and simply gambled with my hard earned money. After that fiasco, I almost gave up investing. My husband encouraged me to learn from the experience and make something out of it, and I did just that.

A few months later, when I had partially recovered from the emotional blow, I changed how I approached investing. I adopted principles and ignored all the hype. I was going to do this the patient way, the right way. I picked my mentors carefully and my portfolio thanked me for it.

I put together my own investment rules … actually not really my own. I simply read advice from Warren Buffet and took some of his very simple advice to heart and my portfolio thanked me for it.

Little by little I grew my portfolio. My returns grew from single digits to double digits then triple digits.

Funny thing is, my strategies are so simple, I assumed everyone already knew all this stuff. I didn’t think I was doing anything extraordinary and I still don’t think I am.

Don’t get me wrong – not all my bets have been great. I have gotten greedy sometimes and gotten much deserved discipline from the market for it. I have noticed that almost every time I go against my own simple rules, I expose myself to losing bets. When I stick to my rules, I replicate success over and over again.

A couple of years ago, I was asked by a friend to do a Workshop to help others to get started. This was after I helped her kick start her own winning portfolio. I did the workshop then and helped others to start their journey. Since then I have received many inquiries from people who just need a little help to get started. People who are where I was when I first started.

I’ve decided to convert my Workshop into a 5 day action bootcamp.

This is not for everybody. This bootcamp is only for those who are tired of making excuses, want to save time and get moving. I’m talking about the #NoExcuses kind of people who know that not taking action will only delay their goals.

I am not a financial planner. Far from it. What I have figured out however, are simple strategies that have helped me gain traction in the stock market. It is my hope that with this bootcamp and your determination, I will be able to help you do that too.

So if you are serious about investing and just need some help in getting a jump on it, this bootcamp is for you.

- Do You Want To Start Trading Stocks But Feel Overwhelmed By All The Information Out There? You've Read The Books And Blogs But You Still Are Not Clear On What Next.

-

Do You Hear People Talking About A Windfall In a Trade They Did and Wish It Was You?

-

Have You Heard of Using Options to Make Money From The Stock Market but Don't Know What They Are And How To Use Them?

-

Do You Wish Someone Could Just Show You How They Did It With Real Life Examples And Help You Get Going?

-

Are You At The Point Where You Don't Want To Be Lectured? You Just Want To Get Tangible Actionable Steps That You Can Start Implementing Today?

-

Are You Ready To Take The Necessary Steps To Start Building a 6, even 7+ Figure Portfolio?

If You Answered "YES!" To Any Of The Questions Above,

Then This 5 Day Unsophisticated Investor™ Quick Start Bootcamp! Is For You

See What Others Have To Say ...

I’ll continue to attend and recommend. Thank you!"

- Dr. Judith F.

"Thank you very much. Sure to recommend to friends and families. Besides being very knowledgeable, you have a unique style of breaking down the concepts for your audience. Use of real trading examples and the summary tips are very helpful!"

- Leo N.

- Olive M.

"The course is very helpful to me. It is well structure and has the right amount of content to inspire and motivate a beginner or intermediate investor. I will definitely recommend this to friends; Placing call options was my favorite part!"

- Paul N.

Frequently Asked Questions